Notified supply of food items. Any directindirect export of goods services outside enforcing States.

Imgur Com Advertising Infographic Social Media Marketing Internet Marketing

Supplies of international and intra GCC transport of goods or passengers.

. Businesses are eligible to claim input tax credit in acquiring these supplies and charge GST at zero rate to the consumer. Supply of medicines and medical equipment as notified by the authorities. For purposes of VAT zero rated supplies are treated as taxable supplies.

Standard-rated supplies are goods and services that are charged GST with a standard rate. These are taxable supplies that are subject to a zero rate. Businesses are eligible to claim input tax credit in acquiring these supplies and charge GST at.

I movable property situated outside Guyana at the time the services are rendered. Telecommunications Services thats exported. The zero rating of food items was originally introduced as a means of providing some relief to low-income households which spend a relatively high proportion of their income on zero rated items.

A a supply of services directly in connection with land or any improvement to land situated outside Guyana. Zero-rated items are goods on which the Government. They can recover credit back on their inputs.

2 2017 Malaysian Debt Ventures EPF. Supply of investment gold silver and platinum. The following supplies are zero-rated for the purposes of section 17-.

Below is the list of supplies classified as zero-rated supplies. If their input tax is bigger than their output tax they can recover back the difference. Input tax credits still take into consideration zero-rated supplies and companies can.

GST is collected by the businesses and paid to the government. Gst In Malaysia Explained. Global transportation service for Passengers and Goods.

These are taxable supplies that are subject to a zero rate. Examples include brown bread fresh fruit and vegetables dried mealies and dried beans. What Is Zero Rated Supply In Gst Goods Services Tax Gst Malaysia Nbc Group.

He cited raw chicken which was zero-rated and marinated chicken which was not as an example where traders could possibly get around the system. Uparrow Malaysian Gst Enhancement 1st Phase Implementation Home Gst Malaysian Gst Enhancement 1st Phase Implementation September 24 2014 Mohd Imran Gst No Comments Contents Hide 1 Introduction 2 Activating Gst Functions 3. Meanwhile the producers of exempt supplies are as the name suggests entirely exempt from.

GST shall be levied and charged on the taxable supply of goods and services. UNDER A CONTRACT WITH. This is a special class supplies subject to VAT at 0.

Supply of precious metals such as gold silver. The question to ask is whether there is a clear and direct nexus between the supply and the land or goods situated in Singapore. List of zero-rated supplies.

Part A Zero rated supplies to public bodies privileged persons and institutions-. Zero rated supplies- Second Schedule. Examples of Zero rated supplies For purposes of zero rating supplies are classified as follows.

Examples of zero-rated goods include certain foods and beverages exported goods equipment for the disabled prescription medications water and sewage services. B a supply of services directly in respect of. But as mentioned above supplies services need to meet all conditions mentioned in UAE executive regulations.

Download form and document related to RMCD. The following supplies traded within the UAE are to be considered as zero-rated supplies. To illustrate a Singapor e contractor renovating a house in Malaysia may qualify for zero-rating as the supply is directly in connection with land situated outside of Singapore.

What items are zero-rated for VAT. Royal Malaysian Customs Department Goods and Services Tax Zero Rated Supplies Order 2014 PERINTAH CUKAI BARANG DAN PERKHIDMATAN PEMBEKALAN BERKADAR SIFAR PINDAAN 2017 PERINTAH CUKAI BARANG DAN PERKHIDMATAN PEMBEKALAN BERKADAR SIFAR PINDAAN NO. Zero-rated supplies which can be either goods or services are supplies to which a VAT or GST rate of 0 applies meaning that buyers do not pay any VAT on them.

The producers of zero-rated supplies do not have to collect GST or HST on the products or services they sell but are entitled to benefits in the form of input tax credits ITCs for GST or HST incurred in the production of the Zero-rated supply. How GST works on a zero rated supply.

Apple Homepod Apple Design Speaker Apple

Waste Reduction Recycling Station Office Recycling Bins Recycle Trash

Schottis Dark Grey Block Out Pleated Blind 100x190 Cm Ikea Pleated Blind Dark Curtains Blinds

Banila Co Clean It Zero Hermo Online Beauty Shop Malaysia Banila Co Beauty Cosmetics Skin Care

Account Suspended Deep Learning Learning Projects Learning

Garnier Skin Renew Dark Spot Corrector Musings Of A Muse Skin Cleanser Products Dark Spot Corrector Daily Moisturizer

Digimon Adventure Digidestined S Digimon Lesser Level Nyaromon Tokomon Bukamon Tanemon Motimon Yokomon Tsunomon And Koromon Tattoo Sleeve Digimon

Malaysia Sst Sales And Service Tax A Complete Guide

Rate Card How Much Social Influencers Charge Brands Social Influence Instagram Rates Influence

Tingby Desserte Roulante Blanc 64x64 Cm Ikea Ikea Side Table Ikea Coffee Table Coffee Table With Wheels

Mandala Bull Poster Zazzle Com Mandala Poster Animal Doodles

Xiaomi Mi Band 5 Official Mi Band 5 Watch Face Band Xiaomi

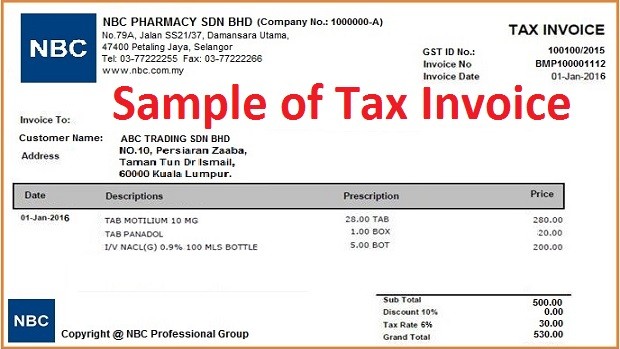

What Is Zero Rated Supply In Gst Goods Services Tax Gst Malaysia Nbc Group

Nasi Lemak Recipe Nasi Lemak Food Processor Recipes Recipes

Bella Belle Adora Flats Formal Size Us 6 5 Regular M B Bride Shoes Flats Wedding Shoes Flats Ivory Fairy Shoes

What Is Zero Rated Supply In Gst Goods Services Tax Gst Malaysia Nbc Group

/dotdash_Final_Zero_Cost_Collar_Apr_2020-01-3f7ffff9ccd84d9e8f93fa3cd72c8d4f.jpg)